Renters Insurance in and around Mooresville

Mooresville renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Mooresville

- Huntersville

- Cornelius

- Davidson

- Sherrills Ford

- Charlotte

- Lake Norman

- Denver

- North Carolina

- Hickory

Calling All Mooresville Renters!

Think about all the stuff you own, from your clothing to tablet to guitar to microwave. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Mooresville renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Why Renters In Mooresville Choose State Farm

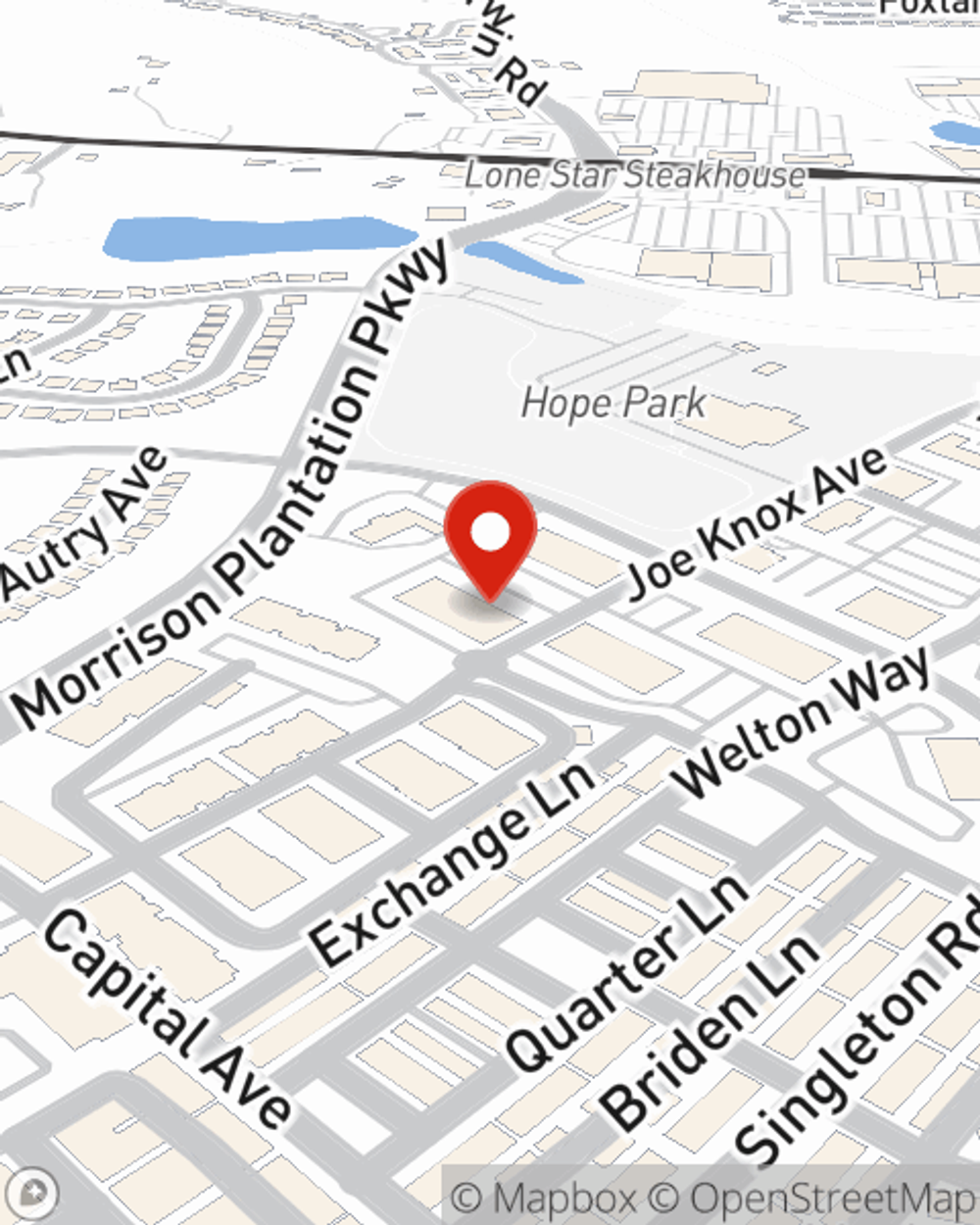

Renting is the smart choice for lots of people in Mooresville. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance could cover the cost of an abrupt leak that causes water damage or tornado damage to the roof, that won't help you replace your possessions. Finding the right coverage helps your Mooresville rental be a sweet place to be. State Farm has coverage options to fit your specific needs. Fortunately you won’t have to figure that out on your own. With empathy and reliable customer service, Agent Annette Burkhard can walk you through every step to help you create a policy that guards the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Mooresville renters, are you ready to see how helpful renters insurance can be? Contact State Farm Agent Annette Burkhard today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Annette at (704) 230-1149 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Annette Burkhard

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.